how are rsus taxed in canada

How Are Restricted Stock Units RSUs Taxed. Jan 22 6 Comments.

California Payroll Conference Ppt Video Online Download

When your restricted stock units vest and you actually take ownership of the shares two dates that almost always.

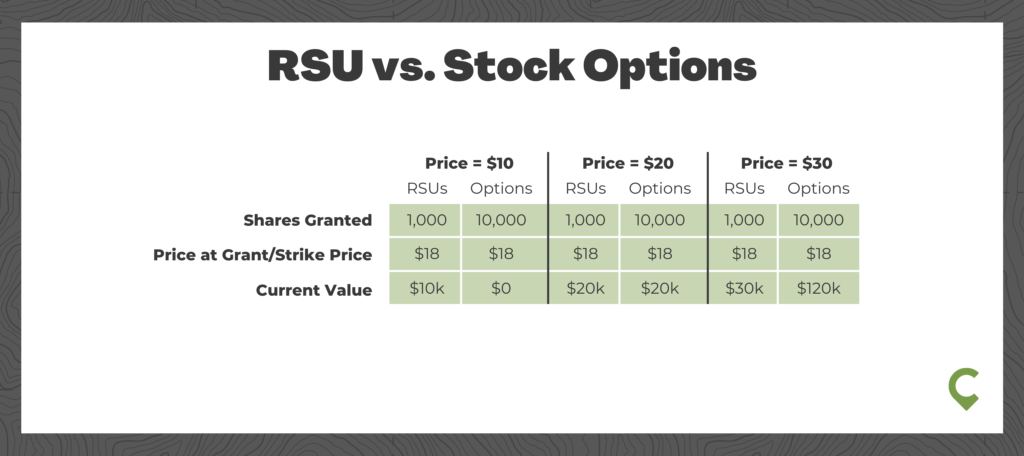

. Long-term capital gains tax on gain if held for 1 year past. A friend of mine told me they typically deduct the highest marginal. Those plans generally have tax consequences at the date of exercise or sale whereas restricted stock usually becomes taxable upon the completion of the vesting.

Taxes must be withheld by your employer and remitted to the Canada Revenue Agency CRA. Taxes at RSU Vesting When You Take Ownership of Stock Grants. Restricted Stock Units RSUs are taxed differently than other forms of equity comp such as Options and Employer Stock Purchase Plans ESPP.

When vested the price difference is taxed as capital gain which count as 50 income. An RSU is one of the many stock-based and equity participation plans provided to employees. The taxable benefit is the difference between the price you paid for the shares the strike price and their value on the date of exercise.

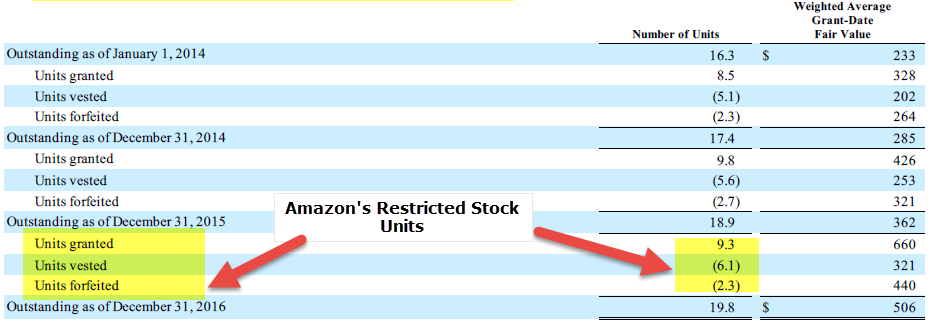

The year of receipt equal to the value of the RSUs or PSUs. Im curious how tech companies do tax deductions when granting RSUs in Canada. The units represent a.

If the RSUs or PSUs are settled. This legal primer provides an overview of the tax. Canadas economy lost 30600 jobs.

However the Canadian tax treatment of commonly granted equity compensation awards is very different than in the US. 613-751-6674 Chantal Baril Tel. When granted RSU is taxed as income.

As title suggests Im trying to find out how are RSUs being taxed in Canada when one vests them and tries to cash in. Generally tax at vesting for RSU. Many employees receive restricted stock units RSUs as a part of.

RSU Taxes - A tech employees guide to tax on restricted stock units. Tax at grant for RS. ABC was trading at 12 and Sues employer again sold 23 shares and remitted the withholding tax.

What you do when they vest will determineif capital gains comes into play. The timing of recognition of the income differs in Canada and in the US so that. If your options were issued and certain other.

In order to hopefully get some kind of an answer lets consider this. In Canada RSU plans are commonly referred to as phantom plans because under an RSU plan the employee initially receives notional units not shares. Restricted stock is taxed upon grant as employment income at a 100-percent inclusion rate.

Ordinary tax on current share value. Taxation of Employee - RSRSU. Sues second batch of 50 units of restricted stock vested on May 1 2012.

This is different from incentive stock. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. Carol Nachbaur April 29 2022.

Canadian Tax Legal Alert CRA issues new views on RSU taxation in Canada April 21 2021 Contacts. For example your marginal tax rate is 30 you got. Taxable amount is fair market value of the shares on the tax event.

In the case of an RSU an employee is granted phantom units that track the value. The day your RSUs vest you will be taxed on them as regular income. Heres the tax summary for RSUs.

How Are RSUs Taxed.

A Guide To Restricted Stock Units Rsus And Divorce

Taxation Of Stock Options For Employees In Canada Madan Ca

/Restricted-stock-unit_final-395366371dc24cfe939e0bc19c0b6102.png)

Restricted Stock Unit Rsu How It Works And Pros And Cons

Rsus A Tech Employee S Guide To Restricted Stock Units

Rsu Taxes Explained 4 Tax Strategies For 2022

The Blunt Bean Counter Punitive Income Tax Provisions

The Taxation Of Stock Options In Canada Is Likely To Change The Mystockoptions Blog

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

What You Need To Know About Restricted Stock Units Rsus Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Restricted Stock Units Definition Examples How It Works

How To Manage Us Rsus And Stock Options Awards When Living Overseas Money Matters For Globetrotters

Online Tax Guide For Individuals Departing Canada

About Restricted Stock Units Quicken Help Site

How To Handle Taxes On Company Stock Kiplinger

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

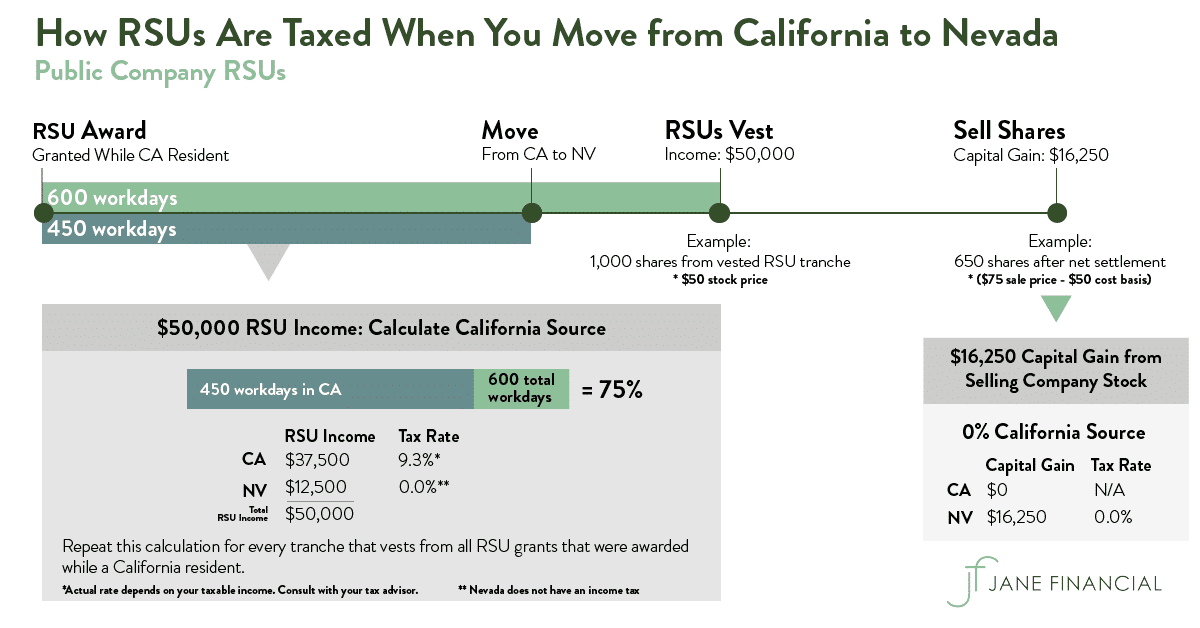

Restricted Stock Units Jane Financial

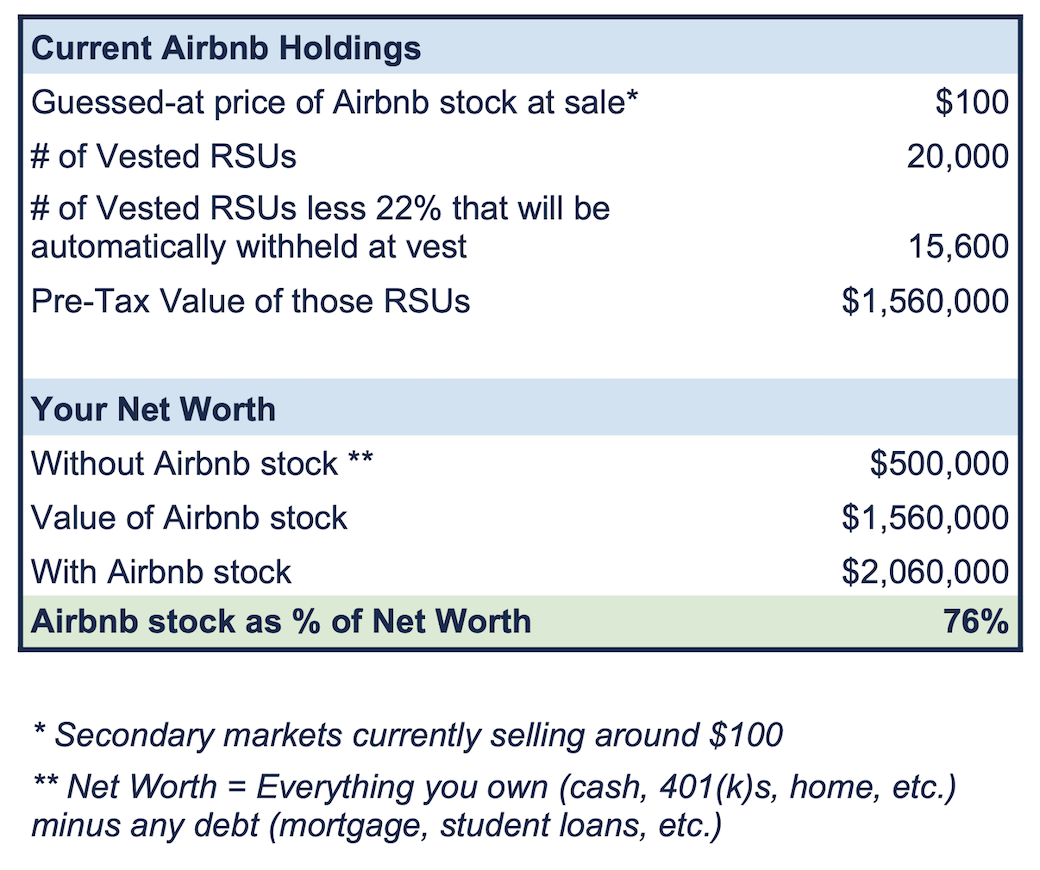

Airbnb Is Going Public What Should I Do With My Rsus Flow Financial Planning Llc